Juvale 25oz Large Wine Glass That Holds A Bottle Of Wine For Champagne, Mimosas, Holiday Parties, Novelty Birthday Gift (750 Ml) : Target

Buy LUCARIS Wedding Gift Delight Red Wine Glasses, 420 ml, 3 pcs Set(2 Wine Glasses, 1 Wine Bottle Stopper),Transparent,Standard,Gift for Couples, Gift for Husband & Wife, Couple Gift (with Gift Box) Online

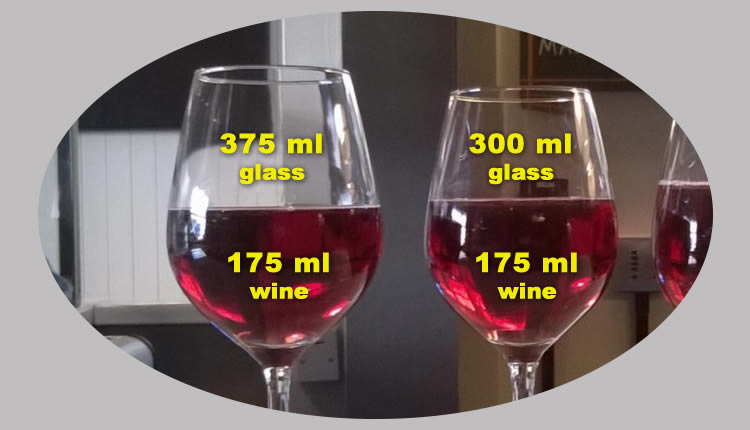

Large 370 ml (left) and smaller 250 ml (right) wine glasses filled with... | Download Scientific Diagram

![How Many Milliliters In A Glass Of Wine? [+Fun Wine Glass Fact] How Many Milliliters In A Glass Of Wine? [+Fun Wine Glass Fact]](https://wineturtle.com/wp-content/uploads/2018/10/wine-glasses.jpg)

![How Many Milliliters In A Glass Of Wine? [+Fun Wine Glass Fact] How Many Milliliters In A Glass Of Wine? [+Fun Wine Glass Fact]](https://wineturtle.com/wp-content/uploads/2018/11/Depositphotos_99015162_m-2015.jpg)

![How Many Milliliters In A Glass Of Wine? [+Fun Wine Glass Fact] How Many Milliliters In A Glass Of Wine? [+Fun Wine Glass Fact]](https://wineturtle.com/wp-content/uploads/2018/11/milliliters-glass-wine.png)